By emphasizing the maintenance of particular relationships within the changing context of finance, TickLab leads the drive for creating a revolution in finance by leveraging technology. It is not just a simple gear change but a revolution driven by Artificial Intelligence (AI) and other platforms like E. D. I. T. H, where the clues lie.

Reflecting on these innovation changes, bargaining powers are reshaping all types of industries, including startups, Yahoo Finance, Google Finance, and Jio Finance share prices, and many big names are following the clues. The importance of both cannot be overemphasized, as it provides a glimpse into a better future of finance that is more open, effective, and stronger than ever for the needs of every CFO, every finance student, and the entire world of finance.

This guide will lead the readers through describing fundamental functions and, in contrast, the disruptive model solution of TickLab in finance, revealing the most crucial generative AI E. D. I. T. H., as the core technology for TickLab’s functioning. This paper will analyze the operational benefits and results of applying E. D. I. T. H. on TickLab from the perspective of decreased risks and increased performance, as well as the specifics of implementing the required modifications in data analysis and monetary services.

Furthermore, the discussion will span the future trends and growth of the innovation tracks that TickLab is creating in the field of finance, as well as portraying the ongoing and future changes in the market. By doing so, this exploration will unveil the critical involvement of entities such as Bajaj Finance, Exeter Finance, and the Ministry of Finance in realizing the integration of these technologies for a secure and affluent financial future, as well as offer a wholesome picture of what is driving the force behind the finance revolution.

TickLab and Its Groundbreaking Approach in Finance

Company Background

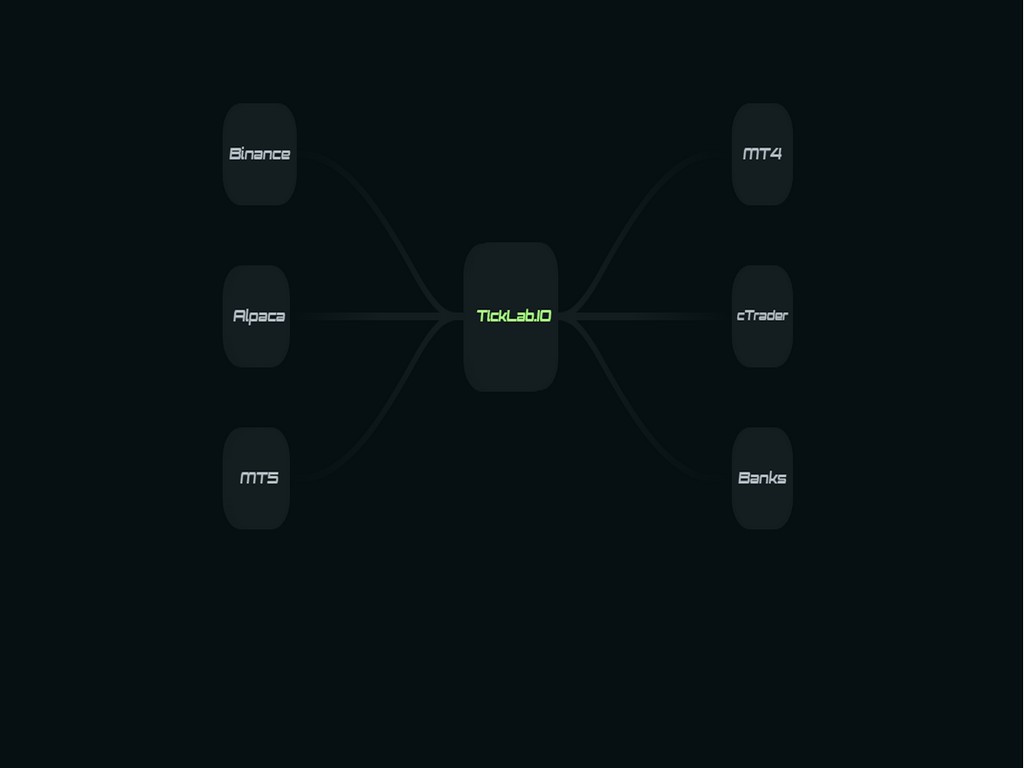

TickLab, that was started by the brilliant CTO Yasir Albayati, becomes one in every of the foremost crucial pioneers in the economic sphere by bringing collectively superior decentralized AI. This approach places TickLab not as the next extra participant in the global of finance but as an undertaken creating a new way in investment management in crypto, stock, Forex markets.

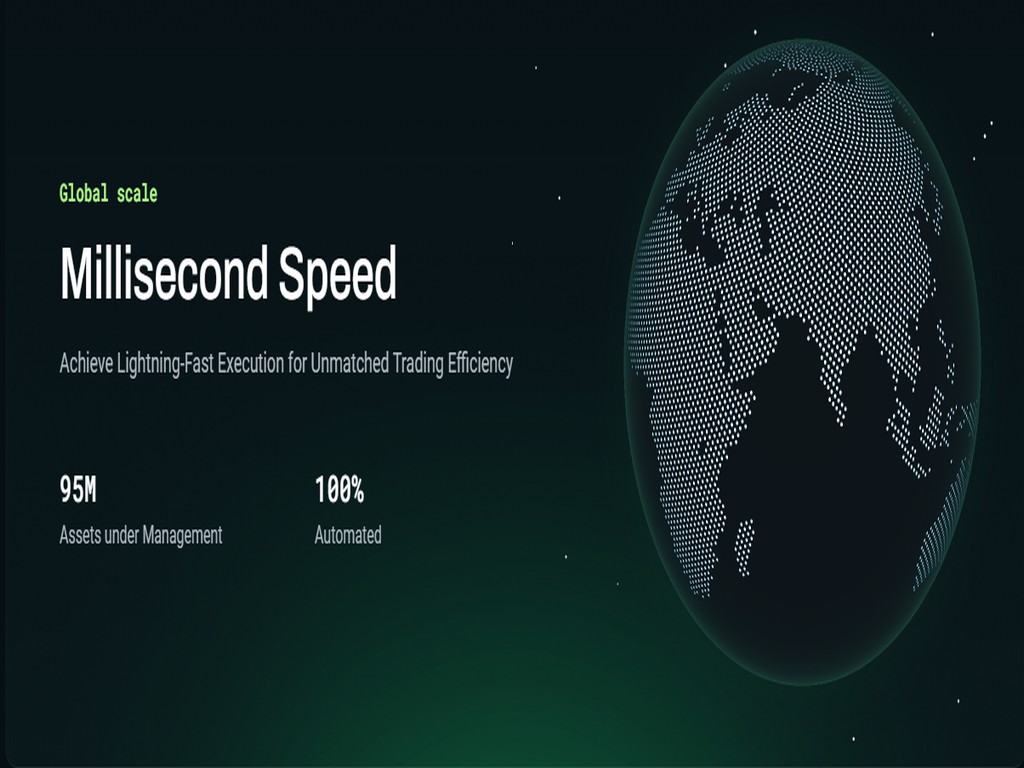

Specialization in Quantitative Hedge Fund Management

TickLab has a competitive advantage in leveraging best solutions based on AI technologies that are offered under its Quantitative Decentralized AI Hedge Fund. This fund employs complex computational models to decipher big data sets then execute trade operations within microsecond that responds to such market movements to get the highest return on investments while at the same time minimising all risks.

This way, TickLab’s AI algorithms enhance themselves with new updates in machine learning and deep learning methodologies so that predictive analysis and strategic planning and forecasting stay accurate.

Unveiling E.D.I.T.H.: The AI Powerhouse

What is E.D.I.T.H.?

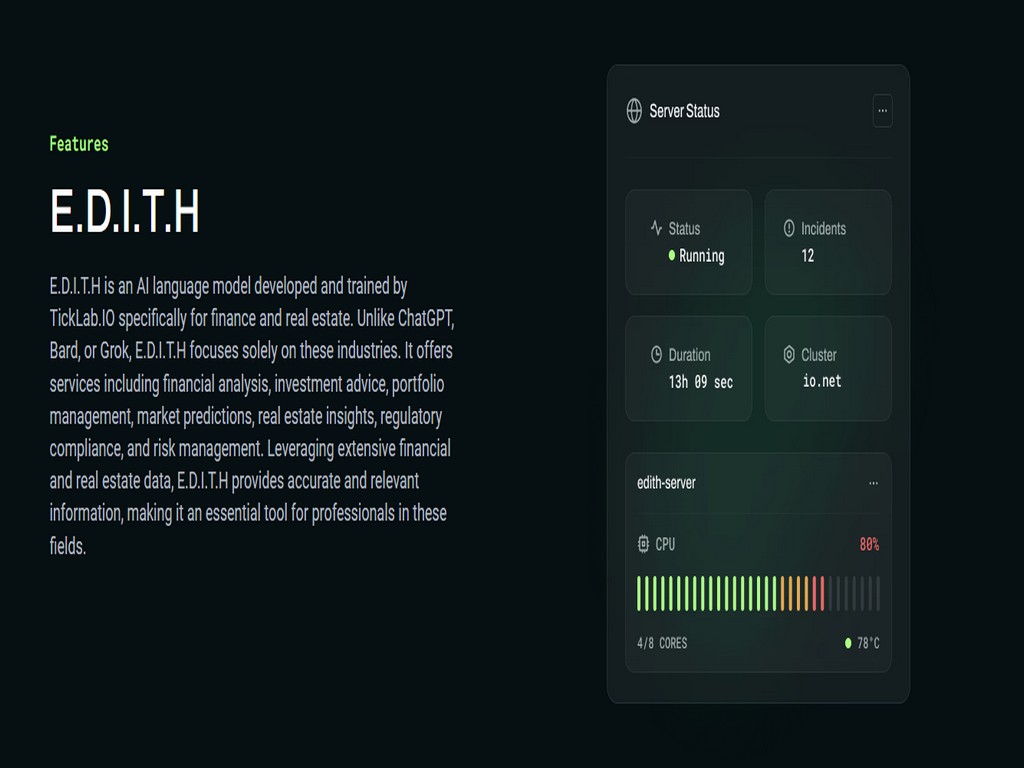

Enhanced Data Intelligence Trading Hub, or E. D. I. T. H. for short, is an A.I. system designed by TickLab. It is intended for finance and real estate companies and offers services like financial evaluation, financial planning, and forecasting. Given this, this powerful A.I. works with vast amounts of information and provides its users with accurate and highly relevant information, making it useful for professionals.

Key Features and Functionalities of E.D.I.T.H.

This is evident in E. D. I. T. H concerning data processing ability and accuracy of identifying trends and trading ability. It employs the best artificial intelligence and machine learning techniques to parse the source data, including past market data or current financial reports. This helps TickLab formulate various investment decisions and control potential risks. Another advantage of E. D. I. T. H. is that the trading in the system is automatic, which makes trades at the most appropriate time, making the operations efficient and accurate.

Impact and Advantages of E.D.I.T.H. on TickLab’s Performance

Enhanced Returns

E. D. I. T. H., the investment arm of TickLab, elevated financial results owing to its machine learning-based solution. These tools process large quantities of data and enable the firm to conduct trades at the best times possible, thus generating high returns while controlling risks. This dynamic approach means that the investment strategies are constantly adjusted to capture the most occurring market trends that put TickLab ahead.

Advanced Risk Management

One of E. D. I. T. H.’s strengths is its ability to predict possible threats that may affect its operations or the environment, and it owes this to its robust data analytics feature. That is why, based on real-time market data and historical trends, TickLab offers a solid base for developing practical risk analysis and subsequent management of risks that can adversely affect the company’s performance in fluctuating markets.

Operational Efficiency

Through such jobs being done by E. D. I. T. H. at TickLab, routine tasks are performed efficiently, negating the chance of committing errors. Market analysis and portfolio management, together with other processes, are tended by this AI system, thus freeing the team to concentrate on strategic planning and innovative methods. This operational efficiency is fundamental in the contemporary world of finance, which is characterized by a great deal of dynamism.

Future Prospects and Innovation at TickLab

Upcoming Developments

TickLab’s future plans consist of continual development of artificial intelligence features, which, in particular, touches on using the E. D. I. T. H. algorithm in more finance and real estate areas. Among the refinements will be developing strategies for using artificial intelligence in organisations to reinvent operational efficiency. Besides, TickLab also aims to broaden the employment of AI to assess creditworthiness for unconventional datasets to widen the areas of applying financial services.

The Role of AI in Shaping the Future of Finance

This is also the right time to remind you that AI is the main value and the focus of TickLab’s activities and growth, with the technology learning to address complex financial information. Future developments will extend to how AI can learn and gain more ability to predict the market and recommend investment. This progress may help change the way finance is done and has the potential to make it better and more accessible for everyone.

Conclusion

We’ve traversed through the fields of TickLab’s nascent innovative practices and the technological AI impact and the finance sector’s game changer, E.D.I.T.H. This venture not only has the potential to set new benchmarks for efficiency and security, but also has the ability to provide personalized financial services.

As a result of the dialogue, we discovered how these recent advancements are the signals of the future of finance that TickLab is projecting forward by leveraging current and future technological innovation with the intent of elevating the sector as a whole to benefit a healthier, more inclusive and fueled dynamism for future financial ecosystems.

The fact that E.D.I.T.H. is fundamentally shifting the operations and management of finance also reflects how AI has the ability to disrupt archaic systems. It’s great that developing E.D.I.T.H.s are paving a path for the future of applying AI in the treatment of finance, and we even think the news is good!

The potential consequences of this shift in the blockchain world are enormous and they will reach CFOs, financial students, and our endowed financial markets. The future of finance is right now at TickLab and as the groundwork adapts and transforms, the finance world is teetering on the brink of an unforeseen level of accuracy, speed and grasp, so much that it would be a tyrannical overreach to challenge the ethics of access and trust.